| October 11, 2021

In-store vs. online retail media: How each one impacts the consumer shopping experience

There’s been a lot of chatter about Amazon’s ad-heavy digital storefront in the past few months, some of it somewhat negative. While the e-commerce giant has historically been praised for being customer-centric, thanks in large part to its relevance and review-based product search rankings, things seem to be changing. If you try searching for a product on Amazon these days, the first page of search results will typically comprise nine sponsored listings, according to a study conducted by data firm Profitero – double the number of ads used by Walmart or Target.

It appears that the company’s fanatical focus on advertising has come at the expense of the consumer’s online shopping experience; now, if you want to make a worthwhile purchase, you’ll have to invest extra time and energy to evaluate brands and avoid potential traps. But as online retail media is facing mounting backlash, many advertisers are realizing that in-store retail media offers similar data-backed benefits—in addition to unique advantages all its own—without negatively impacting the consumer shopping experience.

The rise of retail media: How Amazon is reshaping the advertising industry

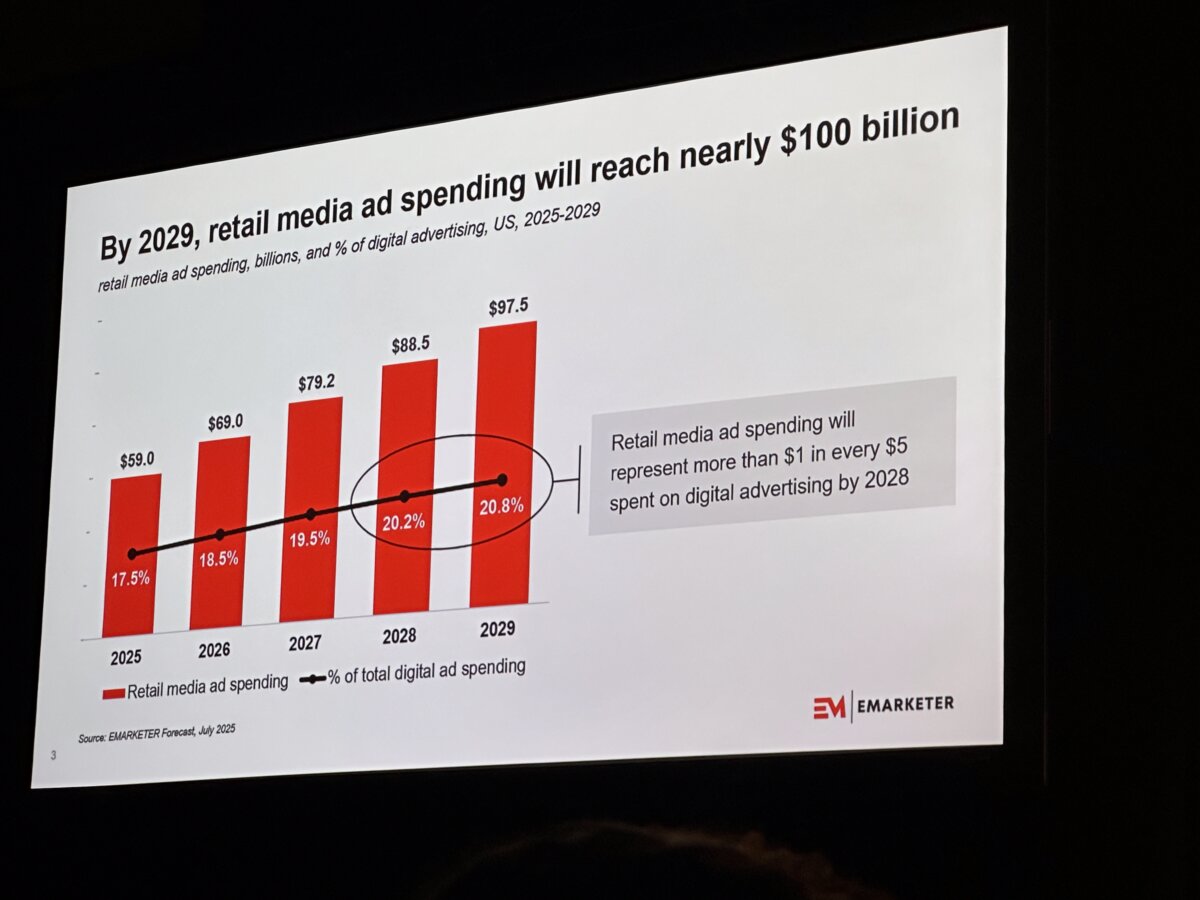

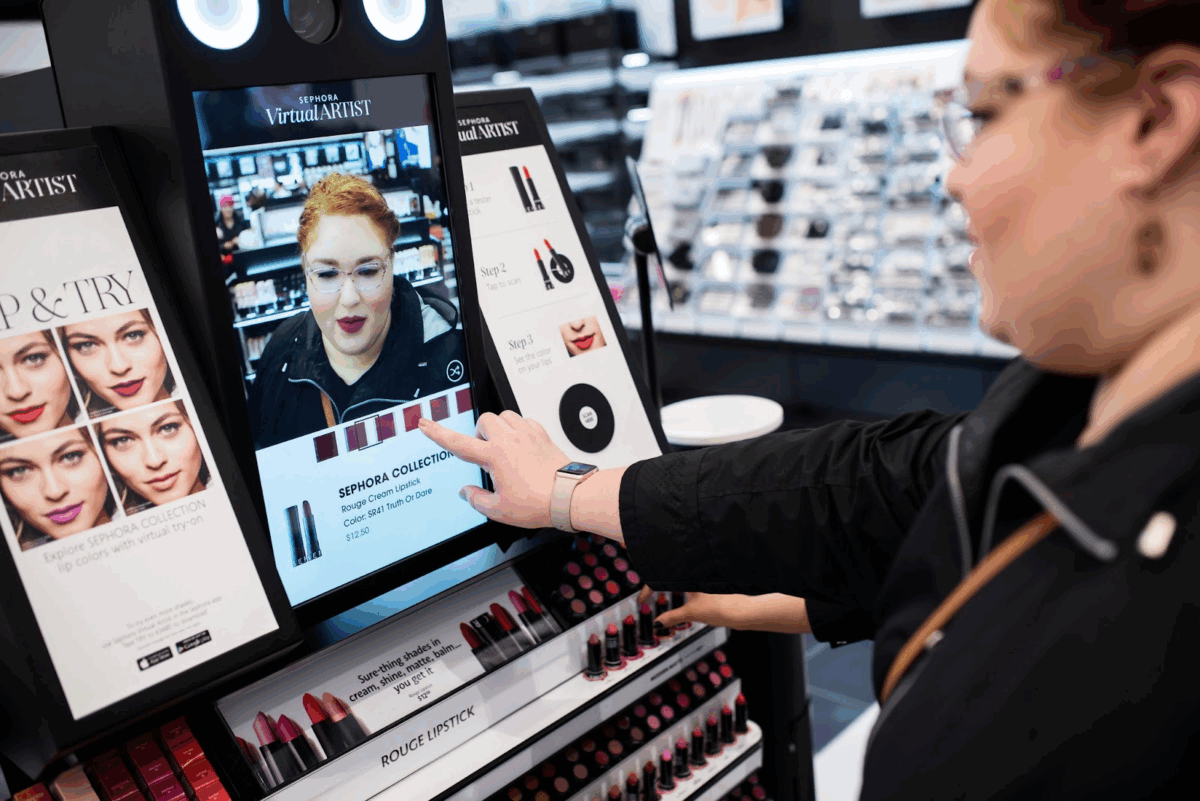

Following in the footsteps of search and social as digital advertising’s third big wave, retail media has already established itself as a force to be reckoned with. A recent report by GroupM found that retail media already represents 10.7% of global ad spend and forecasts that this figure will grow 60% by 2027. Built on a foundation of valuable first-party purchase data, contextually relevant ad experiences, and closed-loop reporting, retail media gives consumer brands powerful new ways to reach shoppers in the environments where their customers are buying. Amazon is at the forefront of this trend; since launching its retail media network in 2012, it’s become the US’s third-largest digital ad platform, trailing only Google and Facebook. Today, retailers like Walmart, Target, and Sephora are following Amazon’s lead by trying to build a marketing business on the back of their existing sales platform.

The rise of retail media has been particularly prominent in the US, where eMarketer estimates advertisers are on track to spend more than $37 billion on retail media networks this year, an increase of about a fifth from 2021. The same report found that while social media currently attracts more ad dollars (forecasting an annual haul of $65 billion), retail media is set to grow more than five times faster in 2022. Part of this growth can be attributed to the fact that many brands are shifting ad dollars they’d previously been spending with Facebook and other online media platforms to retailers—likely due to the fact retail media advertising stands invulnerable against the demise of third-party cookies, as well as increased scepticism regarding the efficacy of digital ads. According to the Financial Times, advertisers added $9.5 billion to Amazon’s global revenue in the third quarter of 2022, while ad revenues at Meta fell 3.7% during the same period.

The impact of putting advertisers ahead of users

While Amazon’s focus on ad tech has certainly been making its shareholders happy—in 2021, the company collected $31 billion from ad sales alone—some industry analysts contend that it has come at the expense of customer-focused recommendations, personalization, and discovery. Many of the sponsored posts showing up in search results are so subtle they look like organic search results. And even when the sponsored posts showing up in search results contain a tiny disclaimer label, these kinds of ads can be misleading because they fill up spaces people assume to contain trustworthy, independent information. Many other online marketplaces and retailer apps are following suit. The result is that retail media advertising is now, in many cases, more akin to dramatically altering shelf placement for specific people than a way to inform and delight consumers or prioritize their shopping experience.

It’s not just consumers who are starting to question online retail media’s resulting impact. Marketers are increasingly asking retailers to prove how much value is actually added by such advertising—especially since it’s not unusual for them to pay at least ten times more for slots on retail media networks than they would for programmatically-sold online ads. Although the returns can ultimately be higher, one limitation of online retail media compared to online ads on the open web is that it’s easy for consumers to shop around to different retailers; there’s little friction standing in the way of a person seeing an ad in one online store and immediately hopping elsewhere to make a purchase. This means that even though online retail media has the potential to generate in-depth performance metrics for advertisers, the ability to track which ads lead to purchases can, in practice, prove to be more difficult than initially thought.

But the online space is only one of the arenas worthy of attention for retail media advertising; retailers are also finding ever more creative ways to turn their physical properties into space they can sell to marketers. Examples of digitized retail media placements inside brick-and-mortar stores include smart screens near the entrance, video displays on shopping carts, and digital retail end cap displays. By incorporating in-store digital media, retailers are able to give their partner brands access to customers close to the point of purchase, whether a customer is shopping on their website or inside one of their physical locations.

The advantages of in-store retail media vs. online retail media

To clarify, advertising, particularly retail media, isn’t necessarily bad. Done the right way, retail media can inform customers about new products and help new businesses get a foot in the door. In particular, in-store retail media has managed to avoid many of the drawbacks outlined above while offering the data- and placement-based benefits that attracted advertisers to retail media in the first place—including access to first-party shopper data, improved campaign targeting, and real-time reporting.

READ ALSO: Why in-store signage advertising belongs in every brand’s retail media strategy

Aside from avoiding the negatives, in-store digital retail media offers some distinct advantages over online retail media for advertisers looking for new and effective ways to connect with their customers. Unlike online, the consumer is seeing the ad in a specific physical environment, and often the advertised product is already right in front of them. This enables brands to reach people who are ready to buy now and are in an environment that inherently introduces more friction to the price comparison process. Online, a different site is just a click away. In the real world, at best, consumers face a long walk to get to another store that may offer a slightly better price on whatever they want to buy.

In-store retail media also allows advertisers to connect with a larger audience since there are simply more people who shop in physical stores than online. While consumers relied more on e-commerce since the start of the pandemic, The NPD Group reported that 2022 was the first year since COVID that consumers expected to make more of their holiday purchases in-store (46%) than online (45%). And the return to brick-and-mortar stores is a trend that extends beyond holiday shopping; according to McKinsey, 20% of consumers say they are now doing all of their shopping in-store, while only 5% shop exclusively online.

And while online retail media ultimately winds up making the consumer experience worse—with online ad placements going to the highest bidder instead of delivering search results based on relevance—in-store retail media is still based on improving the in-person shopping experience. Retail media advertising in physical stores is ultimately only as disruptive as a consumer wants; the inventory displayed on the shelf is the same regardless of whether someone saw an ad or interacted with its corresponding QR code. At the same time, digital in-store signage opens up new storytelling possibilities through the use of dynamic content, offering brands unique opportunities to engage with customers and leave a lasting impression.

READ ALSO: How to enhance the in-store retail experience with digital signage

In short, in-store retail media offers the best of both worlds: it’s a way for retailers to generate additional revenue from brands and a method of delivering a more information-rich and relevant in-store experience.

Are you missing the most valuable piece of your retail media network marketing strategy?

Check out our eBook to learn key aspects every retailer should look for when adding in-store digital marketing to their retail media network.