| October 11, 2021

How to use digital grocery store signage to drive more business

Of all the OOH locations out there, grocery stores may have fared the best during the COVID-19 pandemic. They were, after all, one of the only places people all over could consistently shop at through 2020 and the beginning of 2021. Unsurprisingly, they became hot locations for advertisers looking to connect with audiences who were otherwise difficult to reach outside their homes.

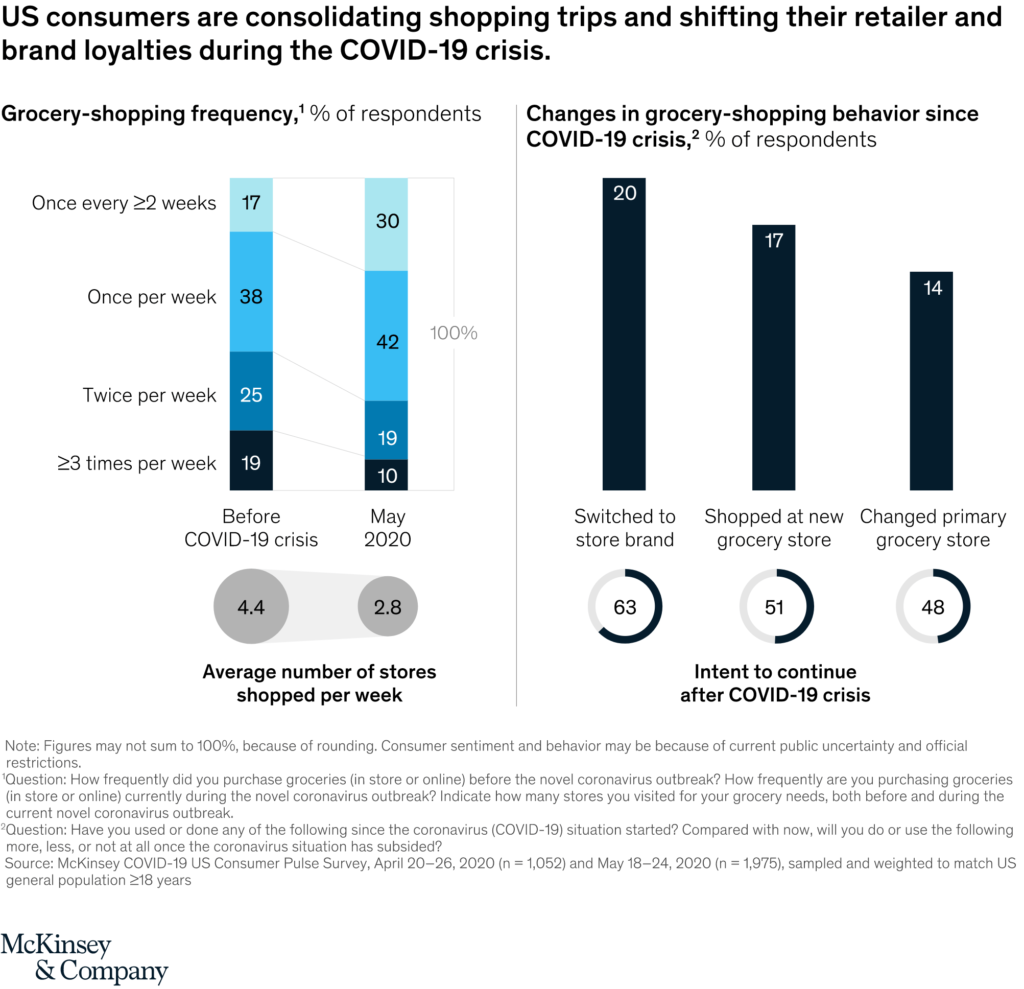

That doesn’t mean grocery stores didn’t change, though. While grocery store sales were up pretty significantly, McKinsey & Company reports that shoppers are shopping at them less frequently, and at fewer stores. Overall, this means fewer opportunities for brands to reach these buyers when they are in the store and at their most receptive.

Fortunately, there’s a solution: digital signage. Deploying digital displays in strategic locations throughout a grocery store location can help create a compelling, contextual shopping experience that speaks to shoppers and leads them to take immediate action.

Boost impulse purchases with digital signage

According to a survey by Slickdeals.net, the average US consumer spends close to $5,400 each year on impulse purchases. About 71% of that money is spent on food and groceries.

These purchases aren’t only spurred on by shoppers seeing something sweet near the register. The majority, in turns out, are in response to sales spotted while in store.

The typical strategy of using stickers and static posters near the goods to advertise a sale can work passably, but it won’t achieve the same level of results as digital signage. Digital point-of-purchase displays have been found to have about 2.5 times as much emotional resonance as static media, making them an influential advertising medium. With food already evoking strong emotional reactions in many people, introducing digital signage is likely to have a notable impact in driving sales.

What’s more, with digital signage placed around a grocery store, deals for sale products can be more widely shared. Where typical in-store sales notices tend to be located close to the on-sale products themselves, digital displays can easily cycle through great deals located all through the establishment. For convenience, they can even include details like an aisle number or store section where shoppers should go to find them.

Integrate digital signage and your PoS system to influence sales momentum

Research from the National Resources Defense Council found that grocery stores waste in the range of 43 billion tons of food each year, representing about 10% of the US food supply. As the global green movement gathers steam, there’s increased scrutiny on this kind of waste, and increased pressure on grocery stores to take action to reduce wastage.

Digital signage presents an ideal solution for meeting this challenge. By integrating the signage system with the point-of-sale solution, it’s possible to automatically shift content to promote products that need to move and stop advertising products that are on the verge of selling out, or have sold out.

Implemented correctly, this type of system can do a great job of nudging sales when needed and reducing the odds of expirable goods going unpurchased. It’s a great tool for reducing food waste, both for environmental purposes and for the bottom line.

Go digital (almost) everywhere to maximize impact

In addition to typical digital displays, grocery stores are deploying digital end cap and shelf-edge screens along their aisles, introducing a new level of dynamism and pop right alongside the products people are buying.

Other types of displays are also beginning to make a splash. Stores like Walgreens have rolled out coolers that include digital displays instead of clear glass doors. The screens offer advertising tailored to nearby individuals, can include special messaging inviting shoppers to perform certain actions (like follow the store on social media) automatically grey out options that are out of stock, and more.

Of course, grocery stores can’t go digital for all of the media they sell. Checkout belt advertising, ads on the handles of grocery carts, branded checkout dividers, and other similar items are unlikely candidates for digitization. For grocery stores looking to monetize their inventory most effectively, opting for digital wherever possible and supplementing with static will yield the best results. These stores should be sure to employ inventory and sales management tools that allow all of these assets to be managed together.

Build up a steady stream of programmatic ad revenue

Online ads are typically delivered programmatically, which means they are sold whenever the conditions of a prearranged deal are met. It’s a powerful process that helps buyers maximize the relevance of their ads with creative messaging or diverse products. For instance, Lipton could decide to run a programmatic campaign on grocery store signage that automatically puts up ads for iced tea whenever the weather is hot and sunny, but displays ads for chicken noodle soup when it’s cold and rainy.

Example: Though not a grocery store, Foodora used programmatic DOOH to deliver different ads to its audience depending on whether it was sunny or rainy.

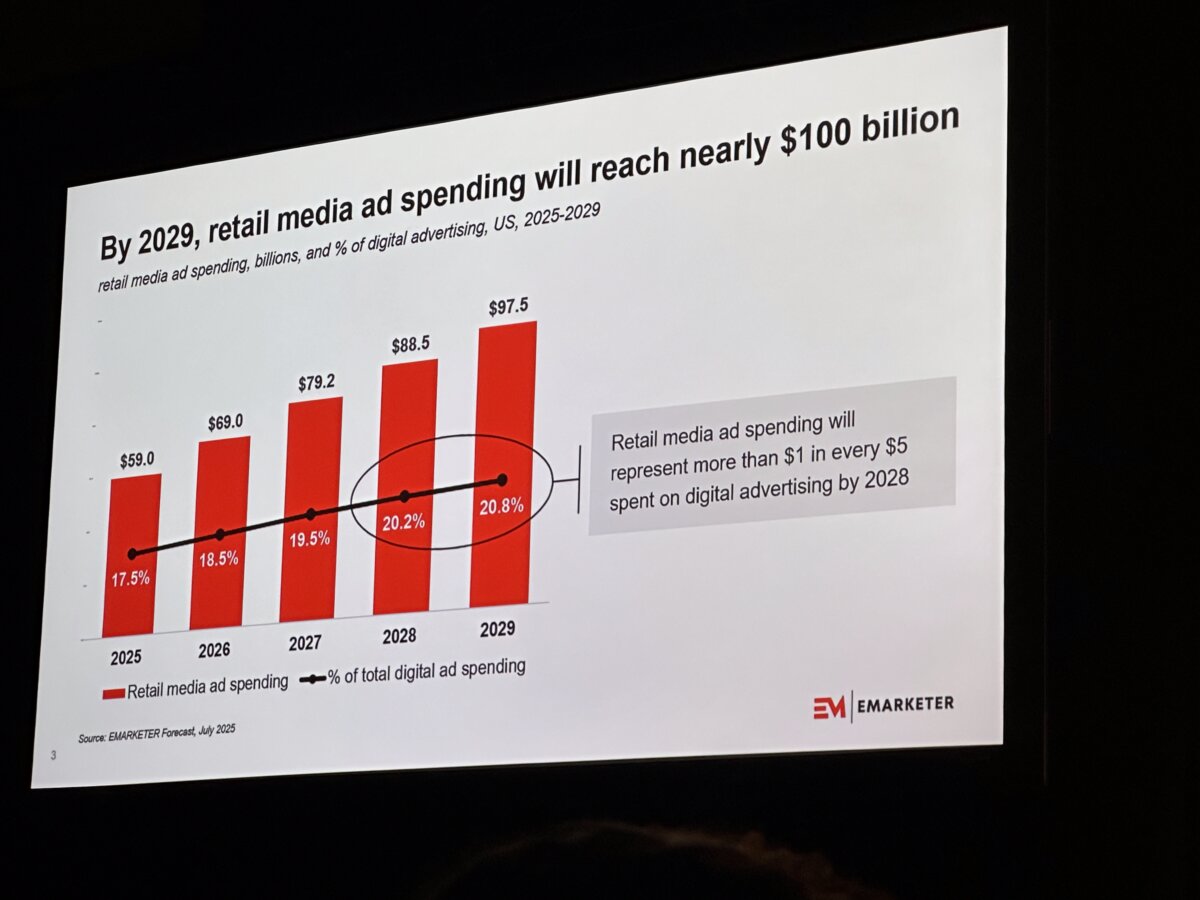

Grocery stores that introduce programmatically enabled digital signage enjoy some other important benefits as well, such as being open for inclusion in big, omnichannel campaigns. Brands today are increasingly hungry for opportunities to deliver their ads across online, social, and out-of-home media at the same time. Programmatically enabled signage appears available for purchase inside the same demand-side platforms media buyers use to buy their other digital media. This makes it possible to include them in these kinds of campaigns.

Programmatic advertising is widely considered to be a key technology for the future, and indeed the present, of DOOH. By delivering that functionality to their grocery store signage, network owners can open up their business to all that that future holds.

Cater to specialty audiences with ads and content

According to research by Specialtyfood.com, specialty products saw an increase in sales of 12.9% for the year 2017, versus just 1.4% for regular food. Grocery stores that embrace this trend and push for new ways to cater to specialty shoppers could quickly find themselves in an enviable position.

There is an abundance of types of specialty foods, with everything from artisanal cheeses, chocolates, organic products, fermented foods, and plant-based options in increasing demand among rapidly expanding fanbases.

Using digital signage to promote a grocery store as a destination for one or more of these types of foods can go a long way to attracting those same fanbases to frequent the store. Content that promotes these foods, advertises new services or events relating to them, or shares fun facts that customers might enjoy can go a long way to grabbing the attention of would-be buyers.

Thanks to its dynamic nature and flexibility, digital signage is quickly becoming a standard for in-store media. Grocery stores looking to connect with brands and customers, advertise their services, and increase impulse purchases will do well to get on board and reap the benefits today.

See how Broadsign customer Starlite Media uses digital out-of-home to drive grocery store and retail sales.