| October 11, 2021

4 post-COVID-19 retail DOOH trends to watch

The world is opening back up, but it is not going back to the way things were. Changes made over the course of the COVID-19 pandemic are expected to stick around, including in the world of retail. New conveniences and preferences may be too appealing or important to let slip away.

This new dynamic in retail will carry a number of important implications for DOOH operators and their retail partners. To maximize success in the years ahead, a few changes may need to be made.

Curbside pickup is here to stay, and DOOH should be there too

Curbside pickup has been around for years. Originally, it was deployed as part of a push towards “buy-online, pickup in-store” (BOPIS) services by retailers looking to compete with the convenience of online-only shopping.

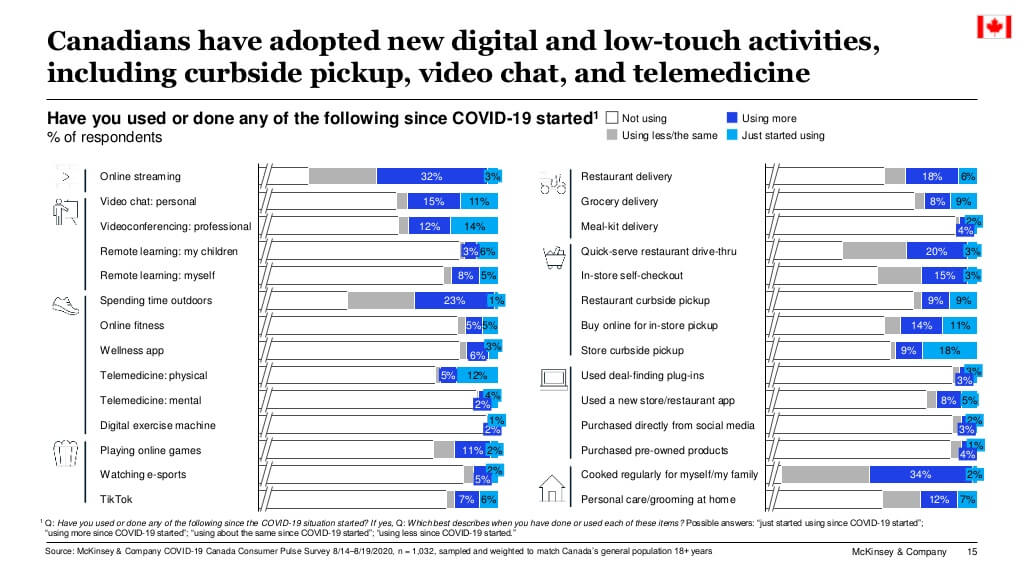

But it’s during the pandemic that curbside really took off. A McKinsey survey of Canadian consumer sentiment showed that 18% of respondents had tried curbside pickup for the first time during the pandemic, with a further 11% continuing prior use throughout.

It’s likely to continue. For one thing, it’s likely to take some time before we fully recover from life under COVID-19. For another, there are indications that consumers will continue to prioritize hygiene and cleanliness even after the pandemic’s end. Both suggest that options to shop hands-off will remain in demand for some time.

This will require some strategic rethinking of how to communicate with customers. Indoor point-of-purchase displays, after all, will not be suitable for providing messaging for an increasing cohort of customers who choose to remain in their cars. Depending on the manner in which curbside pickup is managed at a store, even the common approach of placing digital displays near the entrance to a retailer may not suffice.

Addressing this new reality could be a great opportunity. Curbside pickup, like other BOPIS offerings, is not faster than regular in-store shopping. Buyers who go this route, whatever their reasons for doing so, will be sitting in their vehicles, waiting. Deploying larger displays that are visible from a larger portion of the parking lot, or several smaller DOOH displays distributed throughout a parking lot, could be valuable for reaching this audience while they have nothing else to do.

And for better odds of capturing these people’s attention, media owners should ensure that their selected DOOH platform offers the ability to display dynamically changing content and messaging. This can allow advertisers to deliver different creative based on external triggers, like weather. It can also allow for advertising to display up-to-the-minute information of interest – traffic, weather, news, etc – alongside advertising.

Having these kinds of dynamic content playing around the pickup area will help the screens deliver messaging that better meet the needs and interests of consumers. This will maximize the value for the retailer, the consumer, and the advertiser all at once.

Shift to value-for-money bodes well for relevant DOOH messaging

As you might expect of the economic downturn caused by the pandemic, consumers are demonstrating increased value consciousness in their buying decisions.This will demand that brands change tactics in order to appeal to a different buying mindset, but it also presents an interesting opportunity for media owners with DOOH assets in and around retail environments.

Network owners can use DOOH installations positioned in and around shopping centres, malls, and other retail environments to promote sale items, special promotions, and other kinds of value-focused offerings related to nearby businesses. It’s an easy way to connect buyers with products they want at prices they like, and a good opportunity to leverage the contextual power of location-based DOOH.

Even better, the power of the sale-assisted impulse buy extends beyond just people walking into stores to start their shopping. A survey by Doddle (via Retail Dive) found that 85% of people who go to a store to pick up an online order will make additional purchases while there.

This means that displaying compelling sales content on displays positioned near the entrance to a location, just inside the entrance, or even in parking lots (to appeal to the aforementioned curbside crowd) could go a long way towards generating additional revenue from all kinds of shoppers. There’s stronger immediate appeal in seeing an ad for products purchasable on location, after all, than in seeing an ad for something you would need to purchase later on.

Touchscreens won’t go away, but the way they’re used needs to evolve

We’re big fans of interactive digital signage as a method of delivering ad-supported content and tools to audiences. Interactivity just drives more eye-catching experiences, which is exactly what media buyers and network owners alike want to achieve.

Touch, of course, is the primary type of interactivity deployed across many digital signage installations, and it had its share of detraction even before COVID. Cleanliness has long been a concern, especially after notable stories of harmful bacteria found to be prevalent on touchscreen kiosks. Thanks to COVID, there’s more attention than ever being paid to what we all touch, how clean those things are, and how we can improve hygiene in a bid to stop the spread of harmful bugs.

With all of this said, there’s nothing to suggest that touchscreen interactivity will disappear anytime soon. Now that virtually everyone on the planet has a touchscreen in their pockets at all times, touch has become our default method of interaction, and it’s something more people expect to be able to do with public displays. What’s more, the fact that viruses like COVID-19 tend to spread during interaction with others means that interacting with touchscreens can actually be preferable to many people who would rather avoid speaking to a stranger.

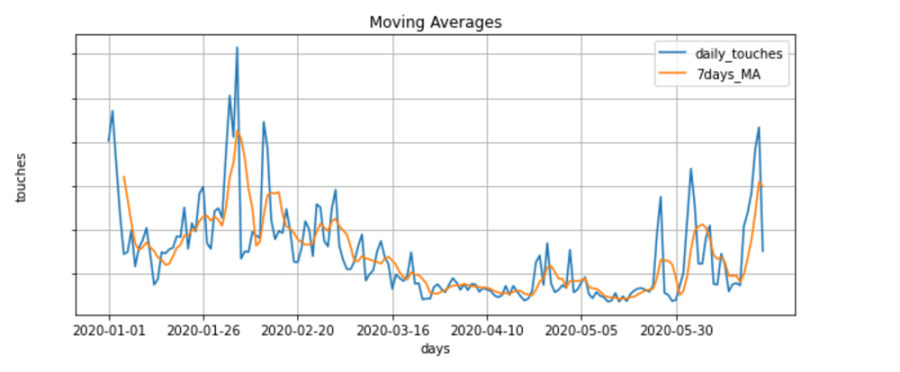

Early data from Perch Interactive seem to back this up, suggesting that engagement with public-facing touchscreens had already rebounded to better-than-pre-COVID levels by late June.

Since touch is unlikely to disappear, the priority becomes finding ways to make the touch experience safer or more palatable to the audience. Simple measures, like offering touchless access to hand sanitizer next to screens, or wipes to clean the display before use, can go a long way to increasing user confidence.

It’s also worth considering changing the manner in which users are expected to interact with a touchscreen. Providing a QR code to send on-screen information to a user’s mobile browser can help limit the amount of time users are expected to interact with a screen to get the info they need. This might draw more users to engage with the screen in the first place, and make a habit of turning to interactive displays for timely and relevant information they can take on the go.

There are many ways to improve on the touch experience, and media owners would do well to explore the various options and see which ones can be incorporated across their networks. It will likely prove a worthwhile use of time.

Additional forms of interactivity are maturing and can help reach more customers

Alternatives to touch interactivity have emerged as increasingly viable options in the past few years. While they may not serve as total replacements for touchscreens, they may be beneficial as options for retail establishments wanting to err on the side of caution, or as a tool for engaging with a cohort of customers who are now reluctant to engage with public touchscreens.

Hand tracking and mid-air haptics technology from companies like Ultraleap, or voice-controlled interaction (another technology seeing huge increases in popularity thanks to mobile) seem to be strong early contenders for touch alternatives in retail DOOH.

It’s important to note, of course, that these options are not perfect replacements. Mid-air gesture control just isn’t quite as mainstream as tapping on a screen. Voice control is notoriously imprecise in noisy environments, and can struggle particularly in correctly registering the words spoken by women, racial minorities, and people speaking with different accents or in different dialects. In other words, it’s a difficult thing to get right in a retail environment with diverse consumers.

Still, incremental improvements are to be expected with these technologies, and deploying one, two, or several different types of interactivity will likely help appeal to a wider range of customers and provide redundancies in instances where a given option is either unpalatable or non-viable.

For media owners with the means, offering multiple options for interaction may prove best in coming out a winner on the other side of the pandemic. In order to successfully take this approach, however, it will be necessary to carefully consider the digital signage platform underpinning the supported functionality. The right choice should help streamline content delivery, integrate easily with all the technologies you want to use, and allow you to leverage your solutions at whatever scale you need, now and in the future.

Want to put your retail DOOH network ahead of the pack?

We can help! Contact us to get started